The Student Loan Debt Crisis Impacts Everyone

Social service organizations, businesses, lenders, foundations and Americans of all ages are witnessing the personal and economic problems associated with the student loan debt crisis.

Of particular concern is the impact on those individuals who now comprise the largest and most diverse generation in American history: Generation Y, also called Millennials, referring to individuals born between the late 1970s and the mid-1990s.

As a result of their record-setting level of student debt, a fragile economy and an unstable job market, Gen Y’ers face major financial hurdles that drastically limit their economic opportunities and delay the attainment of traditional American economic milestones – such as the ability to buy a home – for years to come.

Those most affected by student loan debt are borrowers who left school before graduating. They have the debt to repay, but no degree and are often employed in low-paying jobs and unable to keep up with their student loan payments. Overwhelmed by default, these borrowers are often stuck in what they perceive to be as a no-way-out situation and are unaware that there are options for getting their federal loans out of default.

The Federal Reserve Bank of New York’s August 2014 Quarterly Report on Household Debt and Credit noted that housing debt originations (new mortgage balances on consumer credit reports, including refinanced mortgages) dropped to $286 billion, the lowest level since 2000. In contrast, outstanding student loan balances reported on credit reports increased to $1.12 trillion (as of June 30, 2014)—a $124 billion increase from the previous year.

But the younger generation is far from alone in its struggle with student debt. Many people aged 50 and older have lingering balances on their student loans. In fact, according to the Federal Reserve Bank of New York, student debt is growing faster for seniors than for any other age group. These statistics include individuals who took out student loans for their children as well as for themselves.

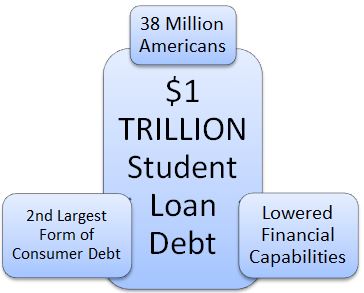

According to the Federal Reserve Bank of New York (2013), 38 million Americans currently owe more than $1 trillion in student debt, constituting the largest form of consumer debt after home mortgages.

How America’s Student Loan Debt Impacts Community Financial Capabilities

Owing money for government-backed student loans is particularly hard to manage because collectors of federal student loans can garnish wages, block benefits (including social security) and withhold tax rebates. In 2013, 156,000 Americans had their social security checks garnished because they had defaulted on their student loans. In fact, the total amount garnished from social security checks in 2013 came to $150 million. (Source: Analysis done by the U.S. Department of Treasury for CNNMoney.)

A majority of Gen Y’ers are worried about repaying their student loan debt, especially those individuals who did not complete their college degrees. According to a report by the Global Financial Literacy Excellence Center, based on its analysis of the most recent (2012) National Financial Capability Study, respondents in the 23-35 subset:

- 54% of respondents with student loans expressed concerns about their ability to pay them off.

- 61% of those with student loan debt but without a college degree expressed those concerns.

(Source: "Gen Y Personal Finances: A Crisis of Confidence and Capability,” Global Financial Literacy Excellence Center, George Washington University School of Business.)

Lack of Awareness of Student Debt Management Options

Studies have found that many student loan borrowers—especially those who have not completed a degree-- are unaware of the best student debt management options available to them.

In fact, many borrowers who carry federal loans don’t realize that they may be eligible for repayment options with more favorable terms than they currently have—terms that may allow them to more responsibly manage their debt and avoid delinquent payments or default.

The Need for More Effective Student Loan Debt Counseling

In his Presidential Memorandum of June 9, 2014, President Obama charged the Secretary of Education and the Department of Treasury with identifying “ways to evaluate and strengthen loan counseling for Federal student loan borrowers.”

Many of the student loan repayment programs offered by the Department of Education are under-utilized because borrowers are simply not aware of the available repayment options and application process that may help them avoid default.

- Borrowers in default may be able to consolidate or rehabilitate their loans in order to get out of default and begin the process of rebuilding their credit histories.

- Borrowers may be able to modify their repayment plan and utilize an income-based repayment plan: Income Based Repayment (IBR), Pay As You Earn (PAYE), or Public Service Loan Forgiveness (PSLF).

- Borrowers with private loans may be able to request forbearance, a deferment, or even refinance their private loans.

By getting unbiased student loan repayment counseling from a quality nonprofit, community service provider, borrowers may be able to avoid default and begin to improve their credit histories.

Student loan debt often prevents a borrower from participating in the economic recovery as they are often turned down for home loans and other forms of credit. By addressing their student loan debt, they are taking the first step in building a strong credit history as well as their financial future.

How CEFC’s Replicable Program Helps Communities Provide Effective Counseling Resources

Most communities today are concerned about enhancing economic opportunities for all residents, but particularly for those who are disadvantaged or experiencing financial distress. Community support is often provided to nonprofit organizations that encourage financial self-sufficiency and assist economic development.

However, assisting consumers with student loan repayment issues that are often a barrier to building financial capability is a tremendous challenge to community service providers. Loan servicers often are not aware of a borrower’s personal circumstance and unable to offer the detailed assistance of a CEFC student loan borrower repayment counselor.

CEFC’s Replicable Student Loan Counseling Program Works

CEFC’s Student Loan Counseling Program has been proven to assist low- and moderate-income individuals in developing financial capability skills essential to self-sufficiency and personal financial management.

CEFC’s innovative program helps financially distressed student loan borrowers succeed in managing their education debt, improving their financial literacy and avoiding delinquent payments and default.

The CEFC program does this by bringing together community resources, supporting counseling innovations, and evaluating results. The program has been put into place successfully in two locations and is fully replicable and ready to go to scale.